Debt Solutions

Fit-for-purpose solutions for you

Our broad transactional and commercial experience in Africa as well as selected emerging markets provide you with a full spectrum of debt solutions and leading capabilities in Africa. We have a proven ability to secure appropriate funds for you on the best possible terms.

Our team draws on the expertise of product and sector specialists across the holistic capabilities of Standard Bank to ensure our solutions are fit-for-purpose and appropriate to your needs.

Some of the benefits

Local specialist expertise

We provide specialist, local capabilities and expertise to deliver world-class solutions to you

Innovative solutions

Our deep industry and country insights help us provide you with innovative solutions, and connect you to the right partners

Established African presence

Leverage our well-established presence across the continent and our wide experience in projects to grow your business in Africa

Africa-China trade capabilities

We provide an unrivalled ability to facilitate trade and investment between Africa and China

Why talk to us

- Assisting you to grow your business: With our Debt Solutions team, it’s not just about making global and African corporates bigger. We’re about growing your business in Africa to build and diversify markets and to increase your ability to successfully engage the global economy.

- We drive Africa’s growth: With a well-established presence across Africa, our wide experience in projects enables us to understand delivery in terms of broader growth trajectories of the economies and regions, making us a key player in driving Africa’s growth.

- Providing you with innovative solutions: Our deep industry and country insights also enable us to provide you with innovative solutions, and connect you to the right partners to support your projects.

- Largest real estate platform: We operate the largest dedicated real estate platform of any financier in sub-Saharan Africa.

- Industrial and Commercial Bank of China (ICBC) partnership: Our partnership with ICBC gives us an unrivalled ability to facilitate trade and investment between Africa and China.

Our offering

- Corporate Financing Solutions

- Project Finance

- Energy and Infrastructure Finance

- Leverage Finance

- Real Estate Finance

-

Why talk to us

-

Our offering

- Assisting you to grow your business: With our Debt Solutions team, it’s not just about making global and African corporates bigger. We’re about growing your business in Africa to build and diversify markets and to increase your ability to successfully engage the global economy.

- We drive Africa’s growth: With a well-established presence across Africa, our wide experience in projects enables us to understand delivery in terms of broader growth trajectories of the economies and regions, making us a key player in driving Africa’s growth.

- Providing you with innovative solutions: Our deep industry and country insights also enable us to provide you with innovative solutions, and connect you to the right partners to support your projects.

- Largest real estate platform: We operate the largest dedicated real estate platform of any financier in sub-Saharan Africa.

- Industrial and Commercial Bank of China (ICBC) partnership: Our partnership with ICBC gives us an unrivalled ability to facilitate trade and investment between Africa and China.

- Corporate Financing Solutions

- Project Finance

- Energy and Infrastructure Finance

- Leverage Finance

- Real Estate Finance

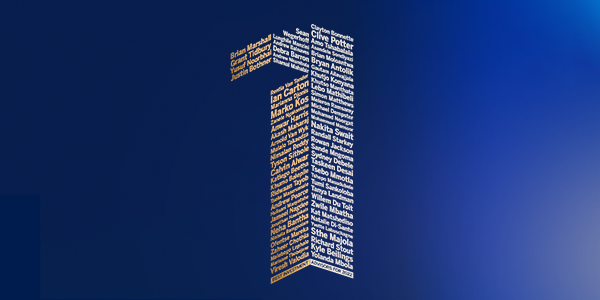

Latest awards

Get in touch

Latest insights from the Group

Economy

2 Mar 2026

In Conversation with National Treasury: 2026 Budget breakdown

South Africa’s fiscal direction remains under close watch as the country works to balance growth, stability and long term reform. The National Budget, presented on 25 February, sets the tone for the year ahead, outlining government priorities and the policy choices shaping the economic landscape.

Trade

10 Feb 2026

Standard Bank driving Africa's trade future at GTR Africa 2026

We will once again play a leading role at the 20th annual Global Trade Review (GTR) Africa 2026 conference, set to take place in Cape Town on 12 to 13 March 2026. The event brings together senior decision-makers, policymakers and trade finance practitioners with over 70 expert speakers and industry leaders.

We also offer