Equity Capital Markets

Leading Equity Capital Markets platform for African issuers

Africa is our home and we raise her equity across Sub Saharan Africa and International stock exchanges

We are experts at positioning and placing African company’s shares, across sectors, to domestic and International investors who best understand and value the region

Our product teams in Africa and London will support your Equity Capital Markets plans

Some of the benefits

Market-leading equity capital market capabilities

In- country expertise

Experienced equities sales and research team

Established African presence

Our Equity Capital Markets team is able to execute and provide advice on:

| Equity | Equity-linked securities |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Proven Equity Capital Markets track record acting on landmark African transactions: Our teams have the experience to deliver your equity raising objectives from local listings or capital raises on your home stock exchange, to supporting regional and multinational companies raise capital on an internationally recognised stock exchange.

- We share the same African DNA: We know how best to articulate and de-risk the African growth story to the most appropriate equity investor base globally and drive value. We understand the strategic challenges of being a listed African sector leader and will partner with you to achieve your equity raising goals.

- In-country expertise: We provide on-the-ground execution teams with embedded regulatory relationships and deep stockbroking and trading capabilities to assist you in ensuring the successful delivery of Equity Capital Market transactions across Africa.

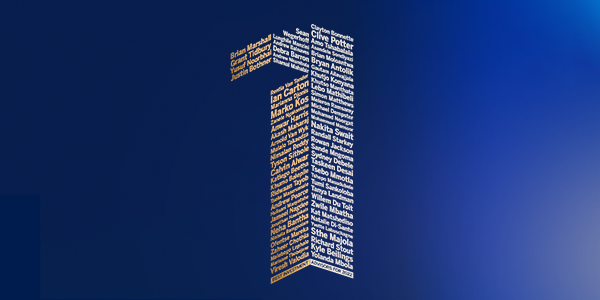

- The largest dedicated equity platform selling Africa to investors globally: No other bank has our depth of distribution strength through our Emerging Market and Africa equity sales specialists based globally. Unique access on Africa into the world’s largest Emerging Market funds, we are Africa’s liquidity provider and the voice that matters for key decision makers on all listed African companies.

-

Our Offering

-

Why talk to us

Our Equity Capital Markets team is able to execute and provide advice on:

| Equity | Equity-linked securities |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Proven Equity Capital Markets track record acting on landmark African transactions: Our teams have the experience to deliver your equity raising objectives from local listings or capital raises on your home stock exchange, to supporting regional and multinational companies raise capital on an internationally recognised stock exchange.

- We share the same African DNA: We know how best to articulate and de-risk the African growth story to the most appropriate equity investor base globally and drive value. We understand the strategic challenges of being a listed African sector leader and will partner with you to achieve your equity raising goals.

- In-country expertise: We provide on-the-ground execution teams with embedded regulatory relationships and deep stockbroking and trading capabilities to assist you in ensuring the successful delivery of Equity Capital Market transactions across Africa.

- The largest dedicated equity platform selling Africa to investors globally: No other bank has our depth of distribution strength through our Emerging Market and Africa equity sales specialists based globally. Unique access on Africa into the world’s largest Emerging Market funds, we are Africa’s liquidity provider and the voice that matters for key decision makers on all listed African companies.